What is an admin and a sinking fund in a body corporate? These Q&As are about transferring money between the admin and sinking fund and also which account pays for what.

Table of Contents:

- QUESTION: Should the cost of a sinking fund forecast be paid from the sinking fund or the admin fund?

- QUESTION: Does a sinking fund forecast have to be done every five years, and does it have to be done professionally?

- QUESTION: Owners voted to approve spending for an item at an amount greater than the budget amount. Funds are available, but do we need to raise a special levy?

- QUESTION: Should replacement of trees be included in the sinking fund budget? We have $5000 in the admin budget to cover garden needs. Our sinking fund forecast has budgeted $4000 a year to replace trees for the next ten years. This seems excessive!

- QUESTION: Can a body corporate use sinking fund money in the bank account to pay for unexpected and high admin fund expenses?

- QUESTION: We are a four lot body corporate and some residents believe that a sinking fund is not mandatory. If sinking funds are not mandatory, why should we have one?

- QUESTION: From time to time we do a major replacement of body corporate boundary fences. If we’ve budgeted for “like for like” but decide to go with an improvement, which fund pays for what?

- QUESTION: With a potential sale of our scheme, it is highly unlikely our old building will be standing in 10 years time. How do we deal with this in the forecast?

- QUESTION: Funds have been transferred from our Sinking Fund to our administrative Fund. Who would have authorised this?

- QUESTION: Is it common for the admin fund contributions to be for a higher amount than the sinking fund contributions?

- QUESTION: We took over from a failing committee and have been working to bring the body corporate back on track. Looking at our sinking fund forecast, we are behind in both funds and maintenance. Where do we start?

- QUESTION: If we do regular painting touch-ups in our building does this come out of the admin or the sinking fund?

- QUESTION: Our sinking fund account is held by our body corporate manager in their own cash management fund. What guarantees do we have that the sinking fund is secure?

- QUESTION: Is there a percentage value that a sinking fund needs to be and if so what is the percentage? I realise it may vary depending on the site and available facilities.

- QUESTION: Can money in the cash account be used to pay for a shortfall in the Administration Funds?

- QUESTION: When preparing our budget, should we reasonably expect the Body Corporate Manager to take into account the sinking fund forecast?

- QUESTION: Our building insurance is due soon. We intend to pay the insurance premium from the sinking fund and then recover this money from the administration fund over the year as lot owners pay their fees. Is this allowed?

- ARTICLE: What’s in your sinking fund forecast?

- QUESTION: What is the reason for not having separate accounts for an admin and a sinking fund in a body corporate? And why are body corporates prohibited from transferring money from one fund to the other?

- QUESTION: When raising additional funds for remedial works, is the amount divided equally or by lot entitlement?

- QUESTION: Our body corporate manager has paid an admin cost out of our sinking fund. What is the best course of action, as requests to the Body Corporate manager appear to be ignored?

- QUESTION: Administrative fund expenses have wrongfully been paid out of a sinking fund. The committee/body corporate manager refuses to correct this error. To fix the error, funds would need to be transferred from the sinking fund to the administrative fund. Would this be in contravention of the Standard Module Regulation?

- QUESTION: For our Insurance Valuation, the Body Corporate Manager advises that the cost should be debited to the Admin Fund rather than the Sinking Fund. What is your opinion on which strata account we should debit?

- QUESTION: We are installing solar panels. Does the expenditure for this come from the sinking fund or a special fund set up to collect and pay for this one off expense?

- QUESTION: We do not have enough in our sinking fund to carry out much needed painting. Can I demand the building be painted, stating it must be done otherwise we are in breach of the legislation?

- QUESTION: Can the sinking fund be placed into a term deposit without our permission?

- QUESTION: Is $57,000 a good amount to have in a sinking fund for 6 units including 2 ground floor units with courtyards in Brisbane?

- QUESTION: Our body corporate had a sinking fund forecast done in 2017. According to that, we should have just under $900k in that fund at present. We currently have about half of that. What is the best course of action here? Should a new forecast be done?

- QUESTION: If contingencies are not allowed to be included in the sinking fund forecast, how do we budget for unforeseen expenses during the year?

- QUESTION: What changes can the committee make to budgeting for the 10 year forecast?

- QUESTION: Does the Legislation require the Sinking Fund Forecast to be approved by the owners at a General Meeting?

- QUESTION: For the last two years the Body Corporate has significantly underspent against the current year expense forecast and then rolled the surplus into the next 10 year Sinking Fund forecast.

- QUESTION: Special levy funds were incorrectly paid into the administration account. The invoice was paid from our sinking fund resulting in a sinking fund in deficit.

Question: Should the cost of a sinking fund forecast be paid from the sinking fund or the admin fund?

Answer: As long as the payment allocations are consistent, in line with the budget and make sense to owners.

Reports like this are usually budgeted into and paid for from the admin fund.

However, it is not an absolute rule. You may hear differing opinions on allocations to each fund if you speak to different managers. There’s a certain logic in paying for the sinking fund report from the sinking fund.

The key thing is that payments are allocated consistently, align with the budget, and make sense to owners.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #718.

Question: Does a sinking fund forecast have to be done every five years, and does it have to be done professionally?

Answer: If a genie from a magic strata lamp granted me just one strata wish, it might be to make recommended sinking fund contributions obligatory.

The technical definition for the requirement of maintaining an up to date sinking fund plan is that a body corporate needs to budget for major capital spending for the current financial year and the next nine years.

As most professional sinking fund plans are based on a 15-year projection, it has become a somewhat incorrect industry shorthand to say the plans are required to be renewed every five years when these professional plans stop meeting the requirements of the legislation.

However, there is no requirement to have a professional plan, and there is nothing to stop a body corporate, say, drafting a new 10 year or 11 year plan itself every year or every other year to keep within the boundaries of the legislation.

People might question whether it is good for owners to draft their own plans. That’s up to the scheme to decide, and I can see an argument in favour of this for very small schemes. However, even if a scheme has a professional sinking fund plan, owners aren’t obliged to follow it, and many schemes, perhaps most, don’t. So you might say that if your scheme is not really intending to follow the recommendations of a professional sinking fund plan, there may not be much point in having a professional draft one up.

That said, my empirical observation is that schemes that have professional plans drafted and that follow at least the recommendations for raising funds tend to be much better maintained and happier schemes over the years. Yes, those owners may pay a bit more in levies on a quarter to quarter basis, but the environment of their complex tends to be better, rent yields and sales prices are higher and the owners are more satisfied. If a genie from a magic strata lamp granted me just one strata wish it might be to make recommended sinking fund contributions obligatory.

See the BCCM website for more details on sinking funds: Sinking fund

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in the October 2024 edition of The QLD Strata Magazine.

Question: Owners voted to approve spending for an item at an amount greater than the budget amount. Funds are available, but do we need to raise a special levy?

If owners vote to approve capital expenditure materially more than that allowed for in the sinking fund budget for that item and

- the aggregate of other expenditures in the budget won’t be equivalently underspent, and

- there are adequate funds available, albeit earmarked in the 15-year sinking fund forecast for maintenance;

is there a requirement for either:

- a special levy or

- amending the budget to reflect the increased approved expenditure? If so, do we need to increase the contribution amount of the budget accordingly?

Answer: A special levy would not necessarily be required, although it’s fine to have one if that’s how owners want to fund the project.

If you have the money in the bank, there is no reason why you can’t vote to spend it. Presumably, you have been saving it for just this kind of purpose.

No. A special levy would not necessarily be required, although it’s fine to have one if that’s how owners want to fund the project. Regarding the budget amendments, if you approve works via motions at an AGM then yes, you would amend the budget to include those works, but you don’t have to raise the contributions if you have the money available to cover the costs.

Owners must remember that it is not bad if your sinking fund goes down. The sinking fund is designed to fluctuate as you spend money on the building. You just need to find the balance between your spending today and your potential spending in the future, and considering and applying the different payment options for each project is a good way to do that.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #712.

Question: Should replacement of trees be included in the sinking fund budget? We have $5000 in the admin budget to cover garden needs. Our sinking fund forecast has budgeted $4000 a year to replace trees for the next ten years. This seems excessive!

Answer: ‘Replacement of trees’ – is it part of the routine maintenance of the scheme, or is it a specific project of some kind?

There is no definitive list classifying expenditure items into the admin or sinking fund. There is always some room for interpretation when categorising expenses to one fund or the other. Speak to a hundred body corporate managers about this, and you will probably get a hundred different answers.

Still, according to the BCCM website, money in the sinking fund can be spent on:

- big or one-off items, like painting or structural repairs to common property

- replacing major items, like common property fences or carpets

- other items that should reasonably be met from capital, like pool furniture.

Meanwhile, money from the admin fund can be spent on anything that is not required to be paid from the sinking fund, including:

- regular maintenance of the common property

- insurance charges

- administrative expenses—such as secretarial fees and postage.

So, there may need to be some consideration of what you mean by ‘replacement of trees’ – is it part of the routine maintenance of the scheme, or is it a specific project of some kind? If it is the latter, it would usually be a sinking fund expense.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in the April 2023 edition of The QLD Strata Magazine.

Question: Can a body corporate use sinking fund money in the bank account to pay for unexpected and high admin fund expenses?

In preparation for my new role as treasurer on our committee for the next financial year, I am doing some research.

The webinar, ‘A deep dive into body corporate financials‘ was helpful and presented in an easy-to-understand way to construct and manage a budget.

Around the 29-minute mark, Will responded to a question about the effect of inflation on a budget. As part of his explanation, Will Marquand commented that if a budget blows out for some reason, a body corporate can access the cash in hand. I thought the money in the bank was restricted to use on sinking fund expenditure only, but Will’s comment suggests that money can be used for unexpected administration fund expenses.

Can sinking fund money in the bank account be used to pay for unexpected and high admin fund expenses?

Answer: The admin or sinking fund can have a negative balance, but for the scheme to be solvent, it still has cash in the bank to pay its bills.

For the most part, body corporate funds are kept in a single bank account, and the division between admin and sinking fund accounts is an accounting process rather than an actual divide of having the money in two separate accounts.

On your balance sheet, you should have a line item called something like ‘cash at bank’, and this is the amount of actual cash on hand your scheme has access to. If this number is low for the size of the scheme, near zero or is somehow negative, your scheme is probably in trouble. If it is positive and you can cover your ongoing expenses, the scheme may be comfortable – or at least manageable.

This cash at bank total is made up of monies allocated to both the admin and sinking funds. When the body corporate has an item of expenditure, it is allocated against one of those funds, and the accounts record the deduction from that fund. However, whichever fund you draw from, the cash at bank goes down by that amount. On this basis, it is possible for either the admin or sinking fund to have a negative balance and for the scheme to be solvent, as it still has cash in the bank to pay its bills.

For example, you might have an admin fund recording a deficit of $5000 and a sinking fund recording a surplus of $100,000. Cash at bank would be $95,000. Although it is not good to have a deficit in the admin fund, the scheme might not be that concerned in the short term because they could meet their ongoing expenses using the cash available. The admin fund might come back into surplus upon payment of levies, or an adjustment might have to be made to achieve this when creating a new budget. A situation where you might commonly see this would be after a scheme has paid its largest expense – the insurance premium. Because this tends to be a large payment all at once, not every scheme will have all the money available in their admin funds to cover the payment, but provided they have the cash at bank, it’s not a big problem. The payment can be made from the cash at bank, and if you have calculated the budget correctly, that money can be repaid as levies are paid over the next few months.

Of course, none of this is to say that it is advisable to run a deficit in either fund or that it should be normal or regular practice. Just that provided you have liquid funds available, it’s a manageable situation, and you have some time to resolve matters without having to call an immediate special levy to resolve the issue.

Running a deficit can hurt a scheme when you have to try to bring a fund back into a positive balance. If a fund has finished a year in deficit, the next budget needs to bring that fund back into a surplus. That requires higher levies or a special levy as you have to budget not only for forthcoming expenditures but also to make up for the deficit of the past. There tends to be quite a lot of unhappiness as a result.

Somewhat bizarrely, Queensland’s body corporate legislation doesn’t allow body corporates to budget for a contingency. This doesn’t make any sense to me, as having contingencies in budgets helps prevent deficits. Maybe someone out there can explain why this is considered a best-practice scenario. Still, I would rather have budgets that allow for some unknown expenditures and avoid deficits as far as possible.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #656.

Question: We are a four lot body corporate and some residents believe that a sinking fund is not mandatory. If sinking funds are not mandatory, why should we have one?

Answer: A sinking fund forecast is mandatory.

A sinking fund forecast is mandatory to the extent the legislation states the following;

A Sinking Fund budget must allow for raising a reasonable capital amount from contributions to provide for necessary and reasonable spending for the current financial year, and also to reserve an amount to meet likely spending for at least the next nine [9] years after the current financial year, having regard to:

- likely spending of a capital or non-recurrent nature.

- replacement of major capital items.

- other costs that should reasonably be met from capital.

The legislation does not specifically state who must compile this forecast/budget, however, Quantity Surveyors, as construction cost experts, are the most relied upon professionals in the market to assist with these lifecycle type budgeting estimates. Sinking fund forecasts, when compiled correctly, can help reduce the need for special levies regarding unplanned expenditure. They can also assist the committee when planning maintenance so that funds are available when the work is required. This also goes a long way to ensuring the enduring value of your property investment.

It is typical in the market to provide the body corporate with a 15 year forecast so that the body corporate gets a five year shelf life from the report, all whilst still complying with the legislation. However, the best managed sinking funds are updated annually to ensure levies are raised appropriately (neither too high nor too low) when considering the current financial position of the body corporate, recent works undertaken, upcoming works and current market fluctuations.

Zac Gleeson

GQS

E: zac@gqs.com.au

P: 0419 755 896

This post appears in the April 2023 edition of The QLD Strata Magazine.

Question: From time to time we do a major replacement of body corporate boundary fences. If we’ve budgeted for “like for like” but decide to go with an improvement, which fund pays for what?

From time to time we do a major replacement of body corporate boundary fences. At budget preparation time, the levy for this has always been included on the Sinking Fund Levy.

- If we replace the existing wooden fence with a new wooden fence, is this “like for like” maintenance and therefore, paid from the Administrative Fund?

- If we decide the existing wooden fence is to be replaced by a Colorbond fence, is this considered an improvement and paid for from the Sinking Fund?

- What if the amount has been set at the AGM and included in the Administrative Fund Levy, but when quotes are received, we decided to install a Colorbond fence instead? How can we handle the BCCM legislative requirement that amounts cannot be taken from the Administrative Fund to pay Sinking Fund projects?

Answer: Many things in body corporate life aren’t ideal. The question is how do you handle them. My view is to be reasonable and transparent in your following actions with the aim of reaching a practical solution.

William Marquand, Tower Body Corporate

The legislation is clear in stating that the monies paid into the sinking fund are for:

The BCCM website goes a bit further, with a plain English explanation stating:

Money in the sinking fund can be spent on:

big or one-off items, like painting or structural repairs to common property replacing major items, like common property fences or carpets

other items that should reasonably be met from capital, like pool furniture.

On that basis, the costs of a replacement fence should be paid from the sinking fund.

However, it seems that in this case it the money for the fence has been already be raised as part of the admin fund. Not ideal, but then many things in body corporate life aren’t ideal. The question is how do you handle them. My view is to be reasonable and transparent in your following actions with the aim of reaching a practical solution.

As such, I would consider just paying the money from the admin fund, but putting the decision to do this to a number of pressure tests.

Firstly, you might want to consider how this money was raised. Was it in the budget (apparently it was in this case), or was there a specific motion to raise sums for the repair of the fence? If the answer to either of these questions is yes then it seems there is a reasonable expectation among owners that the funds were raised for the new fence. Owners are expecting and want the works to proceed and that should be the aim of the Body Corporate.

If not, then there doesn’t seem to be a mandate to undertake the works and you should probably start from scratch and look to approve the project through the sinking fund.

Then, to be transparent about the actions you are taking, you could write to owners to explain the situation or look to pass a motion recording what action you are taking and why. A motion might be required anyway depending on the spending limit costs. If owners are happy with this, then can it really be argued that the body corporate would be acting unreasonably if it paid the monies from the admin fund? On the other hand, if they are unhappy then now you know and you have to look at alternatives such as raising a new levy to be paid to the sinking fund. Either way the body corporate has brought the matter forward in a reasonable way to try and achieve its main objective of getting the fence built.

Is there a more technically correct solution than this that would allow the body corporate to adhere more exactly to the legislation? Possibly there is a pathway involving rescinding past motions and passing new ones so that the monies can be moved to the sinking fund. Perhaps monies could be repaid to owners and then a new levy raised in the sinking fund. Maybe you could do an adjustment of paying less into the admin fund next year and more into the sinking fund next. It’s feasible, but solutions like this tend to get complicated, confuse owners and cost money.

At some point you have to weigh up the costs and benefits of the situation and make a decision. Body Corporates shouldn’t play fast and loose with the legislation, but they are also asked to make reasonable decisions. Treading the line between these points can be complicated, but if you are transparent about the action you are taking then it is usually possible to reach an acceptable outcome.

Todd Garsden, Mahoneys

Will’s response covers most of what I would respond with. However, I would comment that:

- The use of the admin or sinking fund has nothing to do with whether the works are maintenance or improvement. I agree with Will that the sinking fund is the correct fund for a fencing replacement.

- The correct legal solution would be to adjust the budget (and consequential levies) so that the funds are effectively raised in the sinking fund – which Will offers up as one of the technical solutions.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

Todd Garsden

Mahoneys

E: tgarsden@mahoneys.com.au

P: 07 3007 3753

This post appears in Strata News #612.

Question: With a potential sale of our scheme, it is highly unlikely our old building will be standing in 10 years time. How do we deal with this in the forecast?

Interest is currently being shown by a number of developers in our 41 year old strata building. It is highly unlikely that the building will be standing in 5-10 years time.

What bearing does this have on our forecasting over the next 10 years for major items like window replacement, balustrade, etc? Monies are accrued now for expenses unlikely to be actualised. To reduce contributions, some owners have requested we remove these items from the forecast. Is this the correct way to deal with the problem?

Answer: The legislative duty to maintain the common property and forecast future expenses cannot be reneged on the basis of a potential sale of the scheme.

This is a really great question, and one that would many BCs would be facing, particularly those older schemes. In QLD under current legislation, you would need 100% agreement from every owner, known as a resolution without dissent, to sell the entire scheme to a developer. In QLD this is often hard to achieve in a larger scheme as even one owner refusing will completely halt the progress of this.

Regardless of any proposed, theorised, hypothetical or contractual arrangement to sell to a developer, a Body Corporate has a legislated duty to maintain the common property, forecast future expenses (10 years worth) and raise sufficient funding for this period in the form of a sinking fund. This legislative duty cannot be reneged on the basis of a potential sale of the scheme.

Should a BC fail to fulfil this duty to maintain the scheme during the period between now and the settlement date of developer purchase, an owner could argue the BC has fallen into disrepair and have a case to seek remedy for damages. Similarly if the proposed sale of a scheme falls through (such as post a world pandemic when many construction companies are falling into receivership) and year 10 rolls around, you will have a significantly underfunded scheme with many maintenance issues, again giving reason for owners to sue the BC.

Dakota Panetta

Solutions in Engineering

E: dakotap@solutionsinengineering.com

P: 1300 136 036

This post appears in the October 2022 edition of The QLD Strata Magazine.

Question: Funds have been transferred from our Sinking Fund to our administrative Fund. Who would have authorised this?

Answer: Money cannot be transferred from one fund to another.

Money cannot be transferred from one fund to another.

The rationale behind this is that it has been raised a specific purpose and should be used for that purpose.

If that is what has happened, then it is a breach of the legislation.

What can happen next or what can you do?

As ever, start by asking the Committee and the Body Corporate manager what has happened and why. If necessary, advise of the legislative requirement. Get as much information as you can. Was it just a misguided decision by a Committee trying to balance a budget? In that case, maybe there could be a simple reversal of the transaction. Or, was it a decision made with the full knowledge of the law and a choice to disregard it anyway? Then you might need to look at making a change in the administrative set-up of your scheme.

If there isn’t a good explanation or response, you could raise the matter with the Commissioner’s office.

If you have an audit scheduled, the auditor is likely to pick up on this and could provide a direction. If you have a regular auditor, maybe you could contact them and ask them to take a look at the financials to confirm your viewpoint.

Longer term, you might consider that as owners look to purchase in your scheme, people looking at the books and records in advance might see the irregularity. Such a finding would likely be a significant red flag for purchasers. There is no definite outcome from taking such an action, but most of the likely outcome are negative.

Are there any other possibilities here? Maybe there is something you are missing? As I say, ask the Committee and see. Is it possible the movement was an adjustment? An item could have been paid from the sinking fund in error and it was determined to pay this from the admin fund on review. If so, then that is OK and it should be possible to explain this and provide a record why.

Please see this link for more info on the admin and sinking funds.

This link is information from the standard module regulation on the transfer of funds.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #596.

Question: Is it common for the admin fund contributions to be for a higher amount than the sinking fund contributions?

I have noticed our admin fees have gone up quite a bit this year, around 20%, while the sinking fund less so.

In addition, we pay around $488 per qtr for the admin fund, and around $270 per qtr for the sinking fund. Is it common for the admin fund to be more than the sinking fund?

We are a 4 lot complex of 1 bedroom older units – no lifts, no pool. Just a shared driveway.

Answer: It’s not unusual to see admin fees fluctuate and the totals contributed to the admin fund usually exceed the amount to the sinking fund.

With levies, the key factor to remember is that they are determined by owners at the AGM. At that stage, a budget is presented based on the anticipated current and future needs of the plan and owners vote on whether to approve that budget or amend it. At most AGMs, there is usually some discussion as to the general finances of the plan, spending plans for the future and why there may be changes to the rates so that owners can make an informed decision about the levy rates they are determining.

It’s not unusual to see admin fees fluctuate and the totals contributed to the admin fund usually exceed the amount to the sinking fund. However, every building and owners group is different and the structure of any individual budget will depend on the needs of the building.

The AGM notice and minutes should give you an idea of why costs may be increasing, but if that doesn’t answer the question, you can always ask the body corporate manager or committee for an explanation.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in the August 2022 edition of The QLD Strata Magazine.

Question: We took over from a failing committee and have been working to bring the body corporate back on track. Looking at our sinking fund forecast, we are behind in both funds and maintenance. Where do we start?

We took over the committee responsibilities for our small strata in a ‘coup’ two years ago after several years of neglect by our predecessors. Since then, we have been getting the body corporate back to a safe and compliant physical state, plus getting the finances into good order. We’ve started looking at the 10 year Sinking Fund Forecast. We are approximately halfway through and although our sinking fund is now in a very good state, the numbers suggest that the extra funds that should have been set aside per the recommendations of the report have either been diverted away or were never saved in the first place.

First instincts are get a new Quantity Survey with some early financial stacking in the first two or three years to allow us to catch up financially, whilst prioritising the maintenance accordingly. With our efforts over the past two years, we’ve arrested the general decay, but I was alarmed at the assertion in a recent webinar that the paint may no longer be providing protection. We are now concerned about the potential consequences of delaying repainting for too long.

The previous committee seem to have lost records of when the last painting was done, although it does look in fairly new condition. I’ve also reached out to the company who possibly painted the building last time to fill in some of the blanks.

The last Quantity Survey was a simplistic ‘fill in a template and we’ll crunch it through our app’ process done by an interstate firm, so – coming from a technical engineering background – I’m not over-confident in the recommendations.

What are all my options to continue to get the body corporate back on track? Are we likely to find ourselves in violation of Queensland or Federal laws around these issues?

Answer: Neglect of common property will find the committee and the BC liable for damages to owners whether that be loss of rent, loss of asset value or safety issues etc.

It is fantastic to see that you have formed a proactive and diligent new committee who are determined to see the state of the corporate body improve from a level of neglect. This is the first step in terms of becoming a compliant body corporate. Under the BCCM Act & Regs for QLD, neglect of common property will find the committee and the BC liable for damages to owners whether that be loss of rent, loss of asset value or safety issues etc.

The BCCM requires a body corporate to operate a sinking fund and the BC must allow for raising a reasonable amount of capital for spending in this financial year and at least the next 9 years of expenditure. As such it is an expectation that the body corporate has reasonably forecast the next ten years of major maintenance and capital replacement. As the industry standard for Sinking Fund Forecasts is a layout of 15 years’ worth of expenses, to ensure the above provision is satisfied, a Body Corporate will need to reassess their forecast or 10 year budget, every 5 years. It is crucial that the body corporate always be able to view the anticipated expenses of the next 9 years for budgeting and levy purposes.

The building inspector completing this report should be able to determine the state and age of the paint of the exterior and appropriately forecast the year it should fall due. Similarly, they can look for signs that would indicate possible waterproofing failure, such as concrete spalling and suggest you engage a remedial specialist.

A sinking fund forecast should be a comprehensive document but simple enough for a layman to read if they were to pick it up. Rather than a templated sheet to fill in, the forecast should be tailored to the nature of the BC and the materials, construction type, age and appearance of the scheme.

Dakota Panetta

Solutions in Engineering

E: dakotap@solutionsinengineering.com

P: 1300 136 036

This post appears in the July 2022 edition of The QLD Strata Magazine.

Question: If we do regular painting touch-ups in our building does this come out of the admin or the sinking fund?

I understand a Sinking Fund is established to cover the cost of “capital works of a non-recurring nature”. All other Body Corp costs are to be paid for out of the Administration Fund.

If we paint our building every 10 years, this clearly should be allowed for and be paid out of the Sinking Fund.

However, if we do touch-up painting in highly trafficked areas every two or three years should this be allowed for in the Administration fund or the Sinking fund? Does it matter which one we use?

Answer: It would depend on the scope of works and cost each time paint touch ups are carried out.

Most Body Corporates will be able to get 10 years out of their painting if they look after it, e.g. if the building’s washed each year. Buildings in a high saline environment or one with harsh afternoon sun in QLD may need to increase frequency to say a 7-8 year cycle, but your painting contractor should be able to advise on this.

Regarding minor painting or sporadic touch ups as needed, a decision by the committee and body corporate manager would need to take place each time deciding whether the work / project would be considered a major expense or simply minor repairs and maintenance.

The legislation around the use of a sinking fund is ambiguous and does not give the clearest definition so your BC manager will be able to assist depending on the scope of works and cost each time.

Dakota Panetta

Solutions in Engineering

E: dakotap@solutionsinengineering.com

P: 1300 136 036

This post appears in Strata News #562.

Question: Our sinking fund account is held by our body corporate manager in their own cash management fund. What guarantees do we have that the sinking fund is secure?

We have considerable funds in our reasonably sized scheme’s sinking fund. Our funds are held by our body corporate manager.

These funds are in the name of the corporate manager’s own cash management fund. They say the funds are invested in the Bank of Queensland. What guarantees do the residents of our scheme have that the sinking fund is secure? What happens if the manager’s cash management fund makes some bad investments and becomes insolvent?

Would it be better to have the funds invested in a bank or a similar large organisation in our own name?

Answer: It is quite common for the name of the account to have the manager’s name in it, however, it MUST be in the name of the CTS.

Whilst there is no requirement in QLD for a trust account to be used, it is a legal requirement for the CTS funds to be invested in an account in their name – definitely note the manager’s name as this also has tax implications on the earnings. It is quite common for the name of the account to have the manager’s name in it, however, it MUST be in the name of the CTS.

If this is indeed the case, I would suggest the owners seek legal advice to avoid any future problems.

Rod Laws

TINWORTH & CO

E: RodLaws@tinworth.com

P: 02 9922 3660

This post appears in the December 2021 edition of THE QLD Strata Magazine.

Question: Is there a percentage value that a sinking fund needs to be and if so what is the percentage? I realise it may vary depending on the site and available facilities.

Is there a percentage value that a sinking fund needs to be per building and if so what is the percentage? I realise it may vary depending on the site and available facilities of the complex but just an approximate idea would be helpful.

Also does the age of the apartment determine any factors of the sinking fund.

Answer: Rather than a percentage, we would expect the minimum balance of a sinking fund to be approx. $1500-$2000 per lot.

A Sinking Fund Forecast is the basis for a Body Corporate Manager and a committee determining the appropriate sinking fund annual levy. This is not often looked at as a percentage of any particular expense, rather a levy that is calculated based on predicted capital expenses for the coming years. Most Sinking Fund Forecasts cover a 15-year timeline of expenses and with this, levies are advised to increase in readiness for future year expenses as needed. This of course will vary depending on how maintenance-heavy the building/ scheme is. For example, a standard format plan would typically require less maintenance than a building format plan as each owner is responsible for the building and surrounds within their own lot. A building format plan has periods of high maintenance including painting of all surfaces, roof replacement and lift replacements etc. Similarly, an older building is likely to have higher maintenance costs as the building materials in this construction are further through their lifecycle, leading to replacement.

In terms of a percentage value of the scheme, no there is no requirement or guide for how much the balance of a sinking fund should be in relation to the value of your scheme. It is entirely maintenance based.

As a typical guide, rather than a percentage, we would expect the minimum balance of a sinking fund to be approx. $1500-$2000 per lot. For example, a 10 lot scheme would have a healthy sinking fund if they had a minimum balance of $20,000. Having worked with thousands of managers around the country, setting up a new scheme, most would advise this is a suitable balance per lot.

If you are unsure of how well funded your scheme currently is or if you are perhaps paying more towards a sinking fund than necessary, the first step is to get an updated sinking fund forecast and let a professional provide a report for you.

Dakota Panetta

Solutions in Engineering

E: dakotap@solutionsinengineering.com

P: 1300 136 036

This post appears in Strata News #528.

Question: Can money in the cash account be used to pay for a shortfall in the Administration Funds?

A Sinking Fund Term Deposit on being transferred to the Villas Cash account to pay for Pool refurbishment will have some cash remaining from the Term Deposit.

Can this money be used to pay for a shortfall in the Administration Funds which will not be able to pay the necessary accounts ( e.g. Insurance, Caretakers Fees, General Managers fees, normal electricity etc.) until after the A.G.M which is in June and levies have been approved until July Quarter 2020.

Answer: What you are suggesting is possible provided there is money available in the current account to pay the admin bills.

The funds released from your term deposit will be paid into the general account for your scheme and expenditure from both the admin and sinking funds is drawn from this. So, from a practical perspective, what you are suggesting is possible provided there is money available in the current account to pay the admin bills.

From an accounting perspective, one fund can’t lend to another. If the admin account doesn’t have sufficient funds to cover expenses it will go into deficit and this amount will need to be repaid at a future date. The sinking fund will continue to show the full amount ascribed to this account even if the actual cash available at the bank is below this amount.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #494.

Question: When preparing our budget, should we reasonably expect the Body Corporate Manager to take into account the sinking fund forecast?

The Body Corporate had a Sinking Fund Forecast prepared. This included an estimate of painting all units in the scheme. This was an expensive task and was predicted to occur a number of years down the track.

The agreement with the Body Corporate Manager includes the following:

“….. Prepare for the purposes of discussion and approval by the committee a draft budget each financial year.”

Is it reasonable for the Body Corporate to expect that the Manager would include provision for the expenditure in the Sinking Fund Forecast to be considered when the Budget is prepared?

How could a Committee be seen to be acting reasonably if no provision was made for expenditure in the Sinking Fund Forecast?

Answer: It is reasonable to expect that the budget takes into account the sinking fund forecast. However, there is no specific obligation to do so.

To specifically answer the question – yes, it is reasonable to expect that the budget takes into account the sinking fund forecast. However, there is no specific obligation to do so.

The body corporate’s obligations are to approve a sinking fund budget which allows for a reasonable capital amount for anticipated sinking fund expenditure. This does not mean that there is an obligation to have a sinking fund forecast carried out by a qualified expert or to even specifically approve a sinking fund forecast.

In Los Monteros [2009] QBCCMCmr 420 the adjudicator relevantly provided:

“The budgets for the next financial year can be based on actual expenditure for the last financial year, with any necessary adjustments. It is not necessary to engage a professional quantity surveyor to prepare a sinking fund forecast, however, some attempt must be made to reasonably estimate anticipated expenditure of a capital nature over a ten year period.”

Ultimately, the body corporate manager would prepare a draft budget as part of their engaged duties to the body corporate, the committee can then amend that budget and then it is up to owners to approve the budget. There is no requirement for any of those steps to be tied to the forecast, although in most circumstances that would be sensible.

The forecast will not always be accurate, and there may be a reason for the budget to divert from the same figures in the forecast. The only way the approved budget could be challenged is if an owner can demonstrate it is not a reasonable amount being raised for the anticipated expenditure required.

Todd Garsden

Mahoneys

E: tgarsden@mahoneys.com.au

P: 07 3007 3753

This post appears in the July 2021 edition of The QLD Strata Magazine.

Question: Our building insurance is due soon. We intend to pay the insurance premium from the sinking fund and then recover this money from the administration fund over the year as lot owners pay their fees. Is this allowed?

We are a new body corporate in QLD. We had our first AGM in February this year & there are 10 lots in the CTS. My enquiries relate to body corporate fees. Firstly, our building insurance is due soon and we intend to pay the insurance premium from the sinking fund and then recover this money from the administration fund over the year as lot owners pay their fees. Is this allowed to occur or does the insurance premium get paid from the administration fund? If there are insufficient funds to pay it, is a special levy/ contribution raised to pay it?

Secondly, lot owners want a CCTV system installed but there has been no budget set aside for this. Is this allowed to be paid for from the sinking fund or is a special levy/contribution to be raised to fund it?

Answer: Budgeting and finance can be particularly hard for new schemes as they typically start with zero in the bank.

Budgeting and finance can be particularly hard for new schemes as they typically start with zero in the bank.

Insurance should be paid for from the admin fund and ideally your first budget should have allowed for this. This might have included the possibility of raising higher levies on an initial basis to ensure sufficient funds for the insurance would be available at the time it was due. If the total of the budget was sufficient for the year it may also have been possible to change the way the levy was split so that the quarterly contributions were unequal with more money paid upfront in the first one or two quarters to allow for the insurance to be paid.

Still, it’s easy to say this after the fact. In practice it seems you may have sufficient funds across the year but some cash flow problems throughout it at times of large expenditure. This isn’t an uncommon problem. For an item like insurance it may be possible to spread the costs out with monthly instalment payments or to lower the total cost by taking out a six month policy – this would save you from having to make a large lump sum payment in one go.

Otherwise, many plans would still pay the insurance from the admin fund with the effect that this fund would go into deficit. The difference would effectively be ‘borrowed’ from the sinking fund (most of the time the money all comes from one account) and as levies are paid over the year the ‘borrowed’ amount is repaid. It’s not great practice to go into deficit but if it helps get you through a cash-flow issue over the short term it’s a practical solution, provided the money is paid back of course.

One alternative to this may be to have a special levy to increase the liquidity of the scheme. Lots of new plans struggle because they want to set up the building but lack the funds to do it. Special levies are rarely welcome but as a starter for the property getting owners to inject some funds can help ease this type of situation.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #487.

What’s in your sinking fund forecast

As documents go, sinking fund forecasts aren’t that too hard to read, but they are packed full of information about the running of a body corporate scheme that’s easy to overlook.

A typical sinking fund forecast starts with some general information about the purpose of the report and the nature of the building, including its age, the number of lots and the unit entitlements. There will also be a line item showing the balance of the fund at the time the report was written, and this figure, combined with the condition of your building, will strongly influence the recommendations that follow.

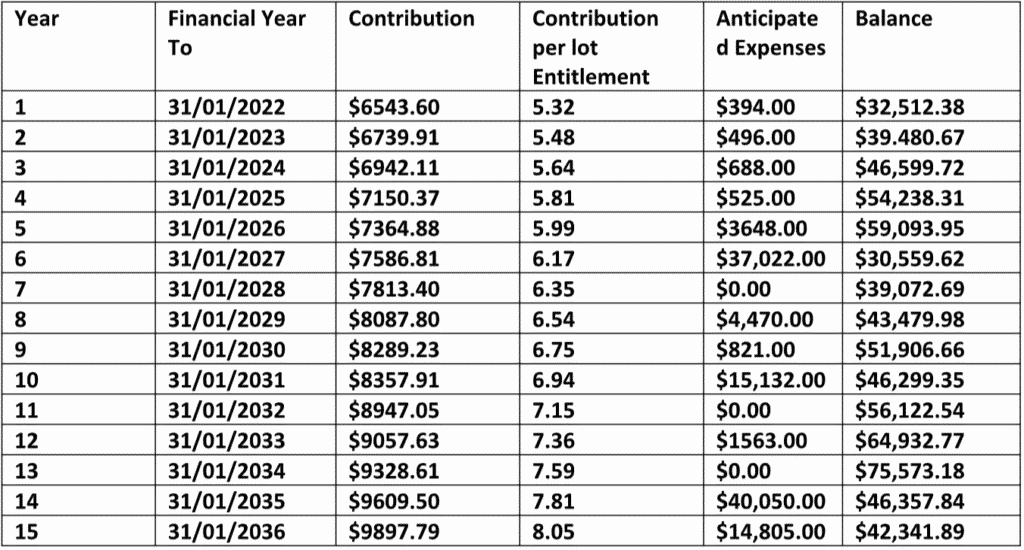

The meat of the forecast comes in the recommended contributions over a 15-year period. Depending on the company you have used to provide your report, the terminology and presentation of this information will vary, but typically you will see a table or some tables that detail proposed annual contributions and spending while setting out the anticipated position of the plan at the end of each period. They may look something like the table below, although this is a condensed version for ease of use.

What information does the Sinking Fund Forecast contain?

Let’s unpack some of that information contained within the Sinking Fund Forecast:

Year/Financial Year to

‘Financial Year To’ is the year of the sinking fund forecast from the date of creation, while the financial year is the financial year of the plan in which the expected contribution should be made.

Contribution

‘Contribution’: tells you how much you should budget for as a sinking fund contribution in that financial year. In the example shown in the above table, the anticipation is that in the financial year to 31/01/2022, the scheme should budget $6543.60. Typically, this is the number that a body corporate manager will list when providing you with a budget proposal for your site as they rely on the forecast for budgeting purposes.

Contribution per Lot Entitlement

‘Contribution per lot entitlement’: tells you how much each unit entitlement will pay as a part of the recommended contribution. It can be a difficult one for people to interpret as owners don’t always think about their unit in terms of entitlements. If you are discussing the sinking fund forecast, it may be beneficial to multiply this figure out so that an actual dollar figure of contribution per lot per annum can be seen. It’s much easier for someone to understand that they need to contribute $960 per annum to the sinking fund than it is for them to know they will pay $7.92 per lot entitlement per annum.

Anticipated Expenses

‘Anticipated Expenses’: These are expenses expected from the sinking fund on a year to year basis. Later in the document, these will be detailed with a breakdown of all expenses. It’s worth noting that while the recommended contributions are usually kept fairly steady with small increases over time to help owners with financial planning, the anticipated expenses can fluctuate significantly on a year to year basis. This reflects the fact that while there may be some quiet years when owners make minimal investments in a scheme, these are likely to be followed by years when a major project is undertaken.

Many people tend to think of the sinking fund as just being for savings, but it is really a guide for spending and the savings are raised to facilitate that.

Balance

‘Balance’: this is the anticipated balance at the end of the financial year. Figures include additional anticipated income from interest via term deposits.

That’s the headline information but the remainder of the document contains some key small print in the anticipated expense and exclusions that can be easy to overlook.

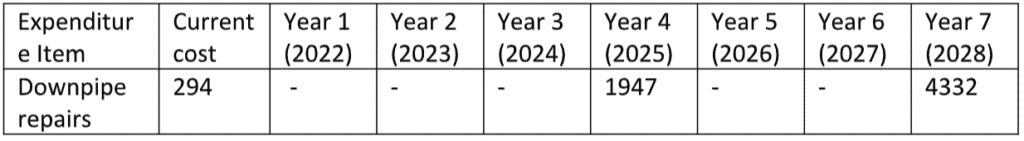

The anticipated expenditures section usually sets out in detailed tables a multitude of standard maintenance items, how much they might cost to repair and when the repair might be anticipated. An individual line item may look something like this:

Here, the reports anticipate an expenditure of $1947.00 on downpipe repairs in 2025 and a further $4332.00 in 2028.

How much faith should you place in the Sinking Fund Forecast?

The obvious question is how much faith should you place in these projections? Well, no one has a crystal ball so the figures aren’t an absolute directive.

If your gutters are in good working order in 2027 when the report is predicting repairs are required, there’s no need to take any action. Equally, the gutters may have had problems earlier than average, and you might have had to pay for them in 2024. Most sinking fund forecasts have some contingency budgeting to allow for this unforeseen expenditure, but otherwise, they will consider the balance of probabilities in their projections and owners will have to be practical in their interpretations of how to undertake expenditure.

This allows some scope for owners to defer payments and works which is why many schemes don’t follow the sinking fund forecasts, but over the long run costs like this often balance themselves out. The gutters may not need work in 2027 but perhaps the intercom system breaks down that same year a couple of years before it should. Schemes that follow the contributions schedule tend to have the capacity to ride these situations out. Those that don’t can find the problems quickly mounting up.

So, What’s NOT Included in the Sinking Fund Forecast?

Just as important as what is included in the report is what is not. Along with checking the expected costs, you need to review the exclusions as there can be some large cost items that aren’t considered.

Safety items aren’t in there. Nor, usually, is fire maintenance or expenses for lifts. Items that are usually

covered in the admin budget, such as maintaining the gardens or air conditioners, are not part of the report. Upgrades, as opposed to maintenance, also aren’t there, so if you want to substantially improve your pool, additional funding may have to be sought. Forewarned is forearmed so even if your scheme followed a forecast to the letter you could still reasonably expect further costs over time.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #471.

Question: What is the reason for not having separate accounts for an admin and a sinking fund in a body corporate? And why are body corporates prohibited from transferring money from one fund to the other?

For accounting purposes body corporates have two accounts – an admin fund and a sinking fund. In practice most body corporate work with one current account from which money from either fund is drawn. This can create confusion over how much money schemes really have allocated to either fund and how much money they really have to use on an immediate basis.

What is the reason for not having separate accounts for an admin and a sinking fund in a body corporate? And why are body corporates prohibited from transferring money from one fund to the other? I can understand that this may not be good practice but ultimately it is the owners money.

Answer: It is important that bodies corporate are unable to transfer money between funds as the money has been raised for a particular purpose.

The body corporate is required to keep various financial statements and proper accounting records which confirm the amounts allocated to each fund – so there is no need for multiple accounts.

It is important that bodies corporate are unable to transfer money between funds as the money has been raised for a particular purpose. For example, if money was transferred from the sinking fund to the admin fund for an administrative expense, all that would do is create a future issue when the money originally earmarked to be used from the sinking fund becomes due.

It is correct to say that this is owners’ money – but more importantly owners have already decided in advance as to how to apply those funds when the levies and budgets were set at general meeting. Transferring funds would contradict that earlier decision.

Todd Garsden

Mahoneys

E: tgarsden@mahoneys.com.au

P: 07 3007 3753

This post appears in Strata News #482.

Question: When raising additional funds for remedial works, is the amount divided equally or by lot entitlement?

Our body corporate is authorising remedial works and maintenance such as roof repairs, painting of the whole building etc. Additional funds are required for the work as there are not enough funds in the sinking fund.

Is the amount divided equally between the number of units OR should the amount be divided by the size of the units [1 bedroom and 2 bedrooms etc]? I only have a 1 bedroom unit and the other units are 2 and 3 bedrooms.

Answer: The expenditure should be divided on the basis of unit entitlement as recorded on the CMS.

The expenditure should be divided on the basis of unit entitlement as recorded on the CMS. This is automatically the case if funds are being used from the admin or sinking fund. If funds are being raised via a special levy the motion to approve this should state that the levy is being raised using unit entitlements. If a different method is being applied there may be a reasonable reason for this, but you would expect this to be clearly outlined in the motion and explanatory notes and may require the consent of all owners to be approved.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #481.

Question: Our body corporate manager has paid an admin cost out of our sinking fund. What is the best course of action, as requests to the Body Corporate manager appear to be ignored?

Our body corporate manager has paid an admin cost out of our sinking fund and this has not been rectified. We are only a smaller entity of 37 Lots. Most expenses are for gardening.

This amount paid in error was not budgeted for in last year’s figures so upsets both admin and sinking fund budgets. It amounts to one third of our costs.

What is the best course of action, as requests to the Body Corporate manager appear to be ignored.

Answer: A motion should be prepared at general meeting to correct the funding issues. This should extend to replenishing the sinking fund for the expended funds through future levies.

A motion should be prepared at general meeting to correct the funding issues. This should extend to replenishing the sinking fund for the expended funds through future levies. Ideally, the committee would arrange for the motion but an owner also has the ability to prepare the motion and submit it at the next general meeting.

Todd Garsden

Mahoneys

E: tgarsden@mahoneys.com.au

P: 07 3007 3753

This post appears in Strata News #461.

Question: Administrative fund expenses have wrongfully been paid out of a sinking fund. The committee/body corporate manager refuses to correct this error. To fix the error, funds would need to be transferred from the sinking fund to the administrative fund. Would this be in contravention of the Standard Module Regulation?

Answer: It wouldn’t amount to transferring amounts between funds but that does not mean there is no remedy available.

It wouldn’t amount to transferring amounts between funds but that does not mean there is no remedy available. It would contravene a separate part of the legislation, being section 148 of the Body Corporate and Community Management (Standard Module) Regulation 2008 (Qld) (Standard Module).

Assuming the expense was one that ought to have properly been paid out of the administrative fund I presume that was because it was not previously budgeted for.

In such a circumstance, the body corporate should be asked to consider a motion:

- raising a special levy for any unbudgeted expense – pursuant to section 141(2) of the Standard Module; and

- reauthorising the expense from the administrative fund with an adjustment made to replenish the sinking fund. This is a better outcome than simply trying to invalidate the resolution for the expense as third parties may have already been paid or the works may be required in any event.

Depending on when the AGM next is, it might be easiest for the motions to be considered at that time to avoid the costs of an EGM.

Todd Garsden

Mahoneys

E: tgarsden@mahoneys.com.au

P: 07 3007 3753

This post appears in the November 2020 edition of The QLD Strata Magazine.

Question: For our Insurance Valuation, the Body Corporate Manager advises that the cost should be debited to the Admin Fund rather than the Sinking Fund. What is your opinion on which strata account we should debit?

Our Committee obtains a fresh Insurance Valuation about every 2 or 3 years eg the most recent one was done in Feb 2019, and the previous one in March 2016. There is no suggestion of obtaining one every year.

The Body Corporate Manager advises that the cost should be debited to the Administrative Fund rather than the Sinking Fund. What is your opinion on which strata account we should debit?

Answer: The sinking fund can only be used for spending of a capital or non-recurrent nature.

Todd Garsden: The sinking fund can only be used for spending of a capital or non-recurrent nature.

The insurance valuation would not fall into that category so must be spent from the administrative fund.

Kaylene Arkcoll: I agree with Todd Garsdens’ advice that the expense should be paid for from the administrative fund rather than the sinking fund.

I think there is a very persuasive section of the legislation which hasn’t been mentioned in the published discussion (see the comment section below).

The section of the legislation which requires the body corporate to obtain a full replacement valuation every 5 years also says how the owners are to pay for that valuation. (This is section 181 in the BCCMA (Standard Module) Regulation.)

- The owner of each lot included in the community titles scheme is liable to pay a contribution levied by the body corporate for the cost of the valuation of the building or buildings that is proportionate to the amount of the premium for reinstatement insurance for the building or buildings for which the owner is liable under this part.

- The contribution that the owner of a lot is liable for may be recovered by the body corporate as part of the owner’s annual contribution to the administrative fund.

The body corporate cannot transfer funds between the Administrative and Sinking Fund accounts. So for the body corporate’s accounts to balance, the insurance valuation must be paid for from the Administrative Fund.

The wording of section 181(4) is identical to the wording of section 182(3), which controls the payment of the building insurance premium from the administrative fund.

The more interesting point is that section 181(3) requires the cost of the valuation to be shared in the same proportions as the cost of the insurance premium.

Section 182 requires the cost of the building insurance premium to be paid by the lot owners:

- based on the interest entitlement schedule of lot entitlements, if the lot was created using a building format plan, or

- based on the proportionate cost of reinstating the lot, if the lot was created using a standard format plan.

The relevant point is that regardless of which of these apply, the cost of the replacement insurance valuation cannot be included as a standard line item in the administrative budget, as these costs are shared using the contribution entitlement schedule. Instead, like the insurance premium contribution, it must be calculated separately.

Todd Garsden

Mahoneys

E: tgarsden@mahoneys.com.au

P: 07 3007 3753

Kaylene Arkcoll

Leary & Partners

E: kaylene@leary.com.au

P: 1800 808 991

This post appears in Strata News #250.

Question: We are installing solar panels. Does the expenditure for this come from the sinking fund or a special fund set up to collect and pay for this one off expense?

I’m the chairperson of our body corporate committee. We have 10 units, two levels, and a common roof space.

We have been looking into solar panels and strata, and the decision to have solar panels added to our complex as part of the body corporate power requirements and usage.

Is this a capital expense or improvement for the complex? Also, can the expenditure for this install come from the sinking fund, admin fund or a special fund set up to collect and pay for this one off expense?

We seem to be of divided opinion, especially regarding which account to debit. Can you shed some clarity on this, please?

Answer: The spending can come from the sinking fund but if it hasn’t been budgeted for previously a special levy would need to be raised.

The installation of a new solar panel set up would be both an improvement and spending of a capital nature. The spending can come from the sinking fund but if it hasn’t been budgeted for previously (which it sounds like is the case) a special levy would need to be raised to replace the funds originally allocated to other spending. There is no ability to set up a special fund other than the administrative or sinking fund.

Frank Higginson

Hynes Legal

E: frank.higginson@hyneslegal.com.au

P: 07 3193 0500

This post appears in Strata News #187.

Question: We do not have enough in our sinking fund to carry out much needed painting. Can I demand the building be painted, stating it must be done otherwise we are in breach of the legislation?

We pay low levies which have not increased since I’ve been an owner. The sinking fund balance is low. When I purchased 5 years ago the building needed painting. This has never occurred.

Painting has been discussed again but the lot owners all say we cannot afford the expense. Can I demand the building be painted, stating it must be done otherwise we are in breach of the legislation? I’m worried the building will suffer structural damage if the painting is not done.

Answer: The ‘sinking fund forecast’ would or should have indicated when repainting was due.

William Marquand, Tower Body Corporate:

If the property needed repainting when you bought it 5 years ago, enquiries should have revealed whether there would be sufficient funds in the ‘sinking fund’, and the ‘sinking fund forecast’ would or should have indicated when repainting was due.

To take this matter further, you may need to seek independent legal advice – which we can’t provide in this forum.

Chris Irons, Hynes Legal:

So it sounds like what you’re saying is that the motion to approve levies for repainting keeps getting defeated. Assuming that’s right then yes, you can challenge that outcome through the Commissioner’s Office. You’d need to demonstrate why the decision to decline is unreasonable. Do you have, for example, a report that shows that the painting is necessary?

One thing you can do before you take that step is to communicate with other owners to say that you intend doing this. That might motivate them to think differently on levies in future. If the next general meeting is yet to take place and the repainting issue is again on the agenda, you can also do some lobbying before the meeting to impress upon everyone why it should pass.

I find that the hip pocket approach generally works well. Impressing upon the other owners that their property values will suffer without repainting (assuming that’s the case) might be a good thing for you to communicate also.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

Chris Irons

Hynes Legal

E: chris.irons@hyneslegal.com.au

P: 07 3193 0500

This post appears in Strata News #431.

Question: Can the sinking fund be placed into a term deposit without our permission?

Could our sinking fund have been placed into a term deposit to get interest without our permission?

Previously we’ve been charged $220 in bank fees for an amount of $2000 in our sinking fund. The only explanation from the body corporate manager was that the amount was for bank fees but we think it may have been a fee to cancel a term deposit and withdraw funds out early.

We thought the sinking fund was for the repair and maintenance of the building. How can we find out what has occurred?

Answer: It is usual practice to put the sinking fund monies into an interest bearing account if not needed immediately.

The sinking fund typically includes:

- owners’ contributions to the sinking fund

- interest received from the fund’s investments

It is usual practice to put the sinking fund monies into an interest bearing account if not needed immediately – otherwise, it’s ‘dead money’.

There is probably a small fee involved in moving money into or out of an investment account, but your first question should probably be whether your committee (assuming there is one) authorised such an investment and if not, whether your body corporate manager has maintained a proper record of the fees reasonably incurred on behalf of the body corporate.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #403.

Question: Is $57,000 a good amount to have in a sinking fund for 6 units including 2 ground floor units with courtyards in Brisbane?

Answer: If there is no sinking fund forecast, a good starting point would be to obtain one in order to both determine whether there are sufficient savings

There is not really enough information on which to base an answer.

For example, what is the age and condition of the complex and has a sinking fund forecast been prepared? If the savings are in keeping with a sinking fund forecast, then the amount is probably ok. If there is no sinking fund forecast, a good starting point would be to obtain one in order to both determine whether there are sufficient savings and most importantly, to plan for the future maintenance needs of the complex and owner levies.

William Marquand

Tower Body Corporate

E: willmarquand@towerbodycorporate.com.au

P: 07 5609 4924

This post appears in Strata News #395

Question: Our body corporate had a sinking fund forecast done in 2017. According to that, we should have just under $900k in that fund at present. We currently have about half of that. What is the best course of action here? Should a new forecast be done?

Answer: If there is a definite shortfall, then something does not add up – maths doesn’t lie!

If the sinking fund balance does not match the sinking fund forecast projection:

- Check that the projection date is correct – the ‘year end’ can sometimes be confusing.

- Check that the budgets match the projected yearly amounts to be raised – otherwise you will fall short.

- Check that the contributions being raised, match what the budget requires – if they don’t you will fall short.

- Check if there are outstanding sinking fund contributions – do they account for the shortfall?

If not, see if significant expenditure has been brought forward, or is for work not in the sinking fund forecast – sometimes work has to be done more quickly than expected, or was not originally accounted for.

After the above, if there is still a shortfall, then something does not add up – maths doesn’t lie!

Once you have the cause/s pinned down, you can then take appropriate remedial action. That may include:

For budgeting mistakes – increase the amount of the contributions (perhaps over time) to make up the shortfall.

For outstanding contributions – take action to recover them, use the discounting and penalty (interest) provisions in the next budget and tweak the contributions upwards.

For work not in the sinking fund forecast – if the work was not in the forecast but it was in the budget, then increase the contributions to cover the shortfall (again consider doing this over time). If the work was not in the budget then there should have been a special contribution (special levy); so there should be no shortfall!

For work brought forward – consider getting an updated sinking fund forecast. Why? Because the forecast takes into account interest earned on the corpus of the fund, to ensure that there is enough money in the fund when it is scheduled to be spent. If you undertake major spending early, then the interest income might not help you meet the next major expenditure.

Michael Kleinschmidt

Stratum Legal

E: info@stratumlegal.com.au

P: 07 5406 1282

This post appears in Strata News #475.

Question: If contingencies are not allowed to be included in the sinking fund forecast, how do we budget for unforeseen expenses during the year?

An article about whether you can have contingencies in a body corporate budget, written by Hynes Legal, states:

If you think it may cost $100,000 for the lifts to be replaced, make the anticipated expenditure (and corresponding sinking fund levies to be raised) $110,000

The dilemma with this is that more often than not the sinking fund budget for a particular year bears no resemblance to the levies to be raised for that year because of the need for levies to take into account future major expenditure, such as the replacement of lifts and building painting that may take place say every ten years.

Our sinking fund forecast for our building (and presumably others) contains a 15% contingency however the contingency is calculated on 15% of the aggregated expenditure for the period of the forecast and divided evenly over that period (increased by an inflation component).

In other words, the contingency in both the annual budgets and the levies raised for each year bears no resemblance to the expected expenditure for that year.

Allocating the contingency to the items already in the budget as helpfully suggested in the article doesn’t get over the problem of the prudent need to allow for expenditure items that aren’t foreseen (a key reason for a budgeted contingency given that known expenditure items can be reasonably estimated when preparing the budget which is often 2-3 months into the financial year) because it isn’t permitted to spend monies for items not in a particular year’s budget.

Based on the above, is it unlawful for contributions to be raised in accordance with the way our forecast is structured?

Is it permissible to use sinking fund monies for capital expenditure included in an annual budget that hasn’t been included in the 10+ year forecast from monies then surplus to requirements because of the over raising of levies arising from the contingency and underspending of forecasted expenditure?

Answer: What the legislation requires and what common sense might dictate should be practice are (unfortunately) not the same thing.

What the legislation requires and what common sense might dictate should be practice are (unfortunately) not the same thing.

We know from adjudications that you cannot include a contingency as a line item in a budget.

If you cannot foresee an expense, then it gets left out of the budget, and a special levy raised as needed – remembering that including an item in a budget itself does not mean that there is the approval to spend that. You still need to go and address any spending limit / quoting issues regardless.

Having said all that, I know lots of bodies corporate include contingencies and then do shuffle around allocations inside budgets when unforeseen issues arise. That is just not in accordance with the legislation and you run the risk of some disaffected (or point-scoring) owner challenging the process.

Regarding your final question: Allocating the contingency to the items already in the budget as helpfully suggested in the article doesn’t get over the problem of the prudent need to allow for expenditure items that aren’t foreseen (a key reason for a budgeted contingency given that known expenditure items can be reasonably estimated when preparing the budget which is often 2-3 months into the financial year) because it isn’t permitted to spend monies for items not in a particular year’s budget.

Yes, provided you comply with the statutory spending limit requirements.

Frank Higginson

Hynes Legal

E: frank.higginson@hyneslegal.com.au

P: 07 3193 0500

This post appears in Strata News #283.

Question: What changes can the committee make to budgeting for the 10 year forecast?

Is it permissible for a Committee to do either or both of the following without seeking approval at a general meeting? Expend, albeit within its spending limit, some 3 to 4 times on a sinking fund budget line item. Bring forward expenditure, albeit within its spending limit, budgeted for the following year in the 10 year forecast, but not allowed for in the current year’s budget.

Answer: These are budgets – they are never going to be perfectly precise.

The important issue to remember is that these are budgets – they are never going to be perfectly precise. Some years budgets will be under, and in other years, they will be over.

The legislation relevantly provides that:

“If a liability arises for which no, or inadequate provision, is made in the budget, a special contribution must be raised.”

A special contribution can only be raised by an ordinary resolution at general meeting. Accordingly, taking a strict interpretation, a general meeting would be required to authorise the additional funding for the unbudgeted expenditure.

However, adjudicators take a more flexible approach as to when this general meeting needs to be held. In Valley Terraces Echohamlets [2012] QBCCMCmr 314 the adjudicator relevantly provided: